The total cost here comprises fixed and variable costs. This BEP analysis helps in determining the number of units or revenue needed to cover the total costs. For instance, in the world of finance and economics, the break-even point refers to the stage where total cost and total revenue becomes equal.

BREAK EVEN POINT FORMULA FOR UNITS HOW TO

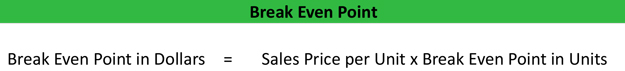

Revenue = Total Variable Cost + Total Fixed Cost How to Calculate the Break-Even Point? Business Break-Even Point Calculationīreak-even calculation is applied to a huge variety of contexts. BEP simply shows that all the costs have been covered, which means: Upon reaching the break-even point means, a business is not either making a profit or loss and thus it is referred as the no-profit or no-loss point. The BEP analysis is considered as a crucial and important financial tool which helps an entity to determine the stage at which the company or any new product will be termed as profitable. What is Break-Even Point?īreak-even point is used in multiple ways in the field of business, finance and investing. So, what exactly does the break-even point mean and at what stage one achieves this? Here’s a detailed guide on the meaning of break-even point and how to determine and calculate it. In this era of start-ups and unicorns, every smart business person would want to know when their business is going to be profitable or when will they reach a break-even point (BEP)? There are other queries in mind as well such as: Is it better to change the pricing structure to fetch profits or how to gain more profits than just recurring losses? It is the break-even point analysis which helps to figure out the answers of these above-mentioned questions.

0 kommentar(er)

0 kommentar(er)